2023 Town Meeting Voter Guide

***TOWN MEETING RESULTS***

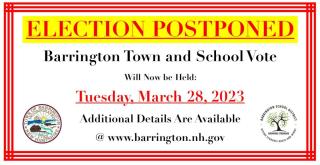

ELECTION POSTPONED to March 28, 2023

In accordance with RSA 669:1 V, the Town and School Moderator has postponed the election to March 28, 2023. Message from the Moderator below:

For the safety of Barrington voters and poll workers, we have decided to postpone the March 14 town and school district election. The National Weather Service has declared a winter storm warning for Tuesday, March 14. The likelihood of snow covered roads, high winds, and power outages could impact voters’ ability to safely participate in the election.

As required, the election will be rescheduled to Tuesday, March 28, from 8 AM to 7 PM. We expect the election to be held at BMS, and we will confirm that. Any absentee ballots already cast will be counted on March 28. Voters who will be unable to attend in person on March 28 may request an absentee ballot from the Town Clerk between now and March 27. All of the rules governing the use of absentee ballots will still apply.

Thank you, and please be careful as we navigate the upcoming storm.

Ron St. Jean

Barrington Town and School District Moderator

POSTPONING MEETINGS DUE TO BAD WEATHER OR OTHER EMERGENCY - NHMA Town Meeting Handbook

Sample Town Ballot (pdf)

Sample School Ballot (pdf)

2023 Town Meeting Voter Guide (pdf)

Executive Summary (tl;dr)

Town Warrant Articles

Important Dates

School Warrant Public Hearing: Tuesday, January 3, 2023 at 6:00pm at the SAU District Office (Video Recording)

Town Warrant Public Hearing: January 10, 2023 at 6:30pm at the Town Hall (Video Recording)

Town Deliberative Session: Saturday, February 4, 2023, beginning at 9am. Barrington Middle School (51 Haley Drive). (Video Recording)

School Deliberative Session: Saturday, February 11, 2023, beginning at 9am. Barrington Middle School (51 Haley Drive). (Video Recording)

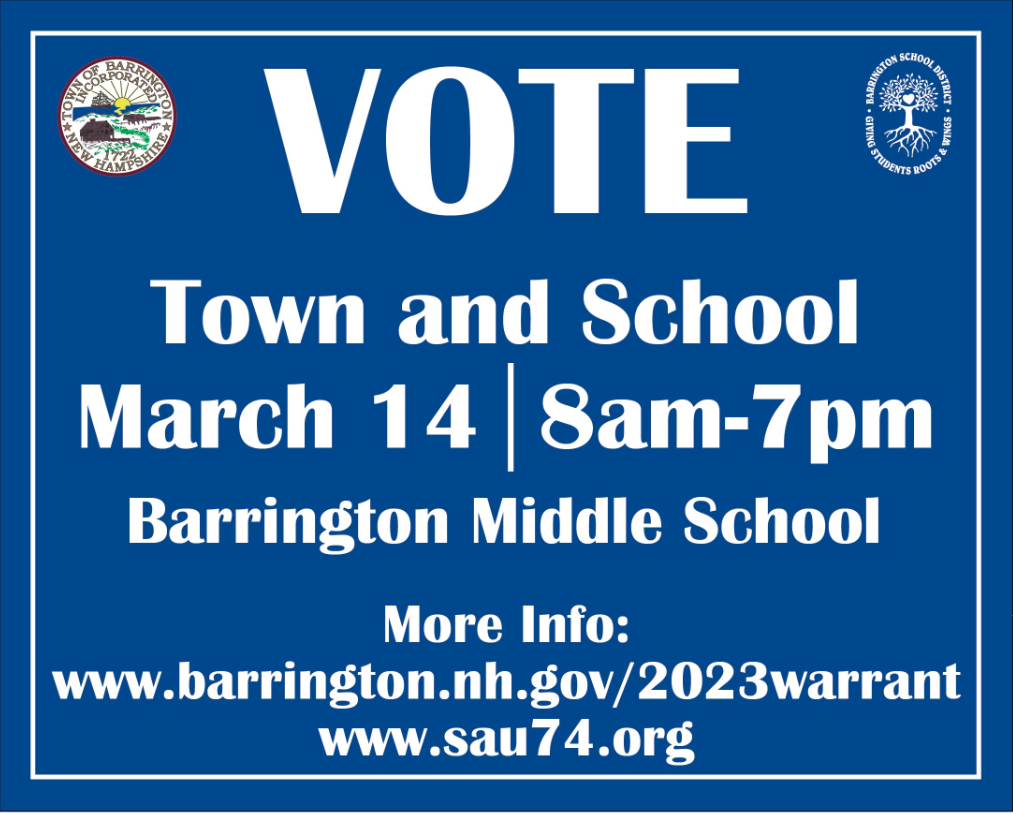

Town Meeting (Ballot Session) voting on Tuesday, March 28, 2023 (postponed from 3/14) at the Barrington Middle School (51 Haley Drive) from 8:00am to 7:00pm

Table of Contents

Introduction and Warrant Development Process

The annual Town Meeting involves two sessions; the Deliberative Session which will be held on Saturday, February 4, 2023, beginning at 9am (Video Recording) and the Voting Session which will be held Tuesday, March 28, 2023 (postponed from 3/14) from 8:00am to 7:00pm (both sessions are at the Barrington Middle School).

The Select Board, Advisory Budget Committee, and Town Staff have been working since September to develop and finalize the operating budget and warrant articles to be presented to voters at Town Meeting in 2023. This guide/webpage is intended to provide additional details regarding each warrant article. The additional information may include documents or video links. Please use the Table of Contents to navigate directly to the information about a specific warrant article. Please note that the School Warrant/Ballot is created by the School District. We will provide details of the SAU #74 process where available, but we would encourage you to visit www.sau74.org for details.

Questions are encouraged, please send all questions to ask@barrington.nh.gov.

Advertising and Promotion Efforts

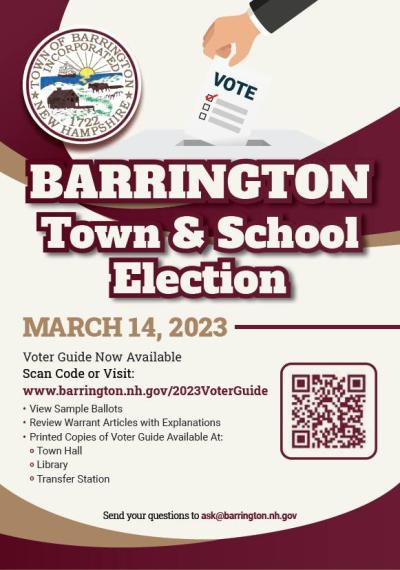

- 2023 Voter Guide (PDF)

- An informational Voter Guide was developed to provide residents with important details and background of the warrant articles to be decided on March 28, 2023 (postponed from 3/14). The electronic version has been advertised with links and scannable QR codes. Printed copies were available at Deliberative Session, Town Hall, the Library, the Transfer Station, and at the election on March 28, 2023 (postponed from 3/14).

- What's That Warrant Article?

- Every day starting on February 8, 2023 we featured a warrant article and explanation on our Facebook Page: www.facebook.com/BarringtonNHGov/. The goal was to inform voters and spur discussion of the ballot items voters will decide on March 28, 2023 (postponed from 3/14).

- Deliberative Session Signs

- On February 3, 2023 we placed eight 'Deliberative Session' informational signs around Barrington. The goal was to inform residents of the Town and School Deliberative Sessions.

- VOTE Signs

- On February 12, 2023 we replaced the Deliberative Session signs with VOTE signs at the same eight locations. The goal was to inform residents of the upcoming election.

- Town Center Property Owner Letters

- On February 27, 2023 we mailed all 205 property owners in the Town Center a letter informing them about Article 9 and what owning property in the Town Center does (and does not do).

- Town Center Tax Increment Financing - Article 9 Banner

- On March 1, 2023 two banners were installed on a sign in the Barrington Town Center. The goal of this sign was to inform residents that the future of the Town Center was on the ballot and where to find more information.

- VOTE Postcard

- On March 3, 2023, a postcard was delivered to all 4,000+ addresses and PO Boxes in Barrington with information about the upcoming vote. The goal was to inform residents of the upcoming election, provide brief details, and information about where to find more information.

Article 1: Election of Town Officers

***

- Select Board Candidates (1 hour, 10 minutes)

- Library Trustee Candidates (50 minutes)

Deliberative Session Video (1 min.)

The filing period for Town Offices was from Wednesday, January 25, 2023 through Friday, February 3, 2023.

Details of the 2023 Candidate Forum can be found at www.barrington.nh.gov/2023candidateforum. A recording of the event is available on the Town's YouTube Channel.

Article 2: Zoning

Deliberative Session Video (3 min.)

Zoning Amendments were developed by the Planning Board review their September 20th, October 25th, and November 15th 2022 work sessions for details.

January 3, 2023 Planning Public Hearing Video Recording (3 min.)

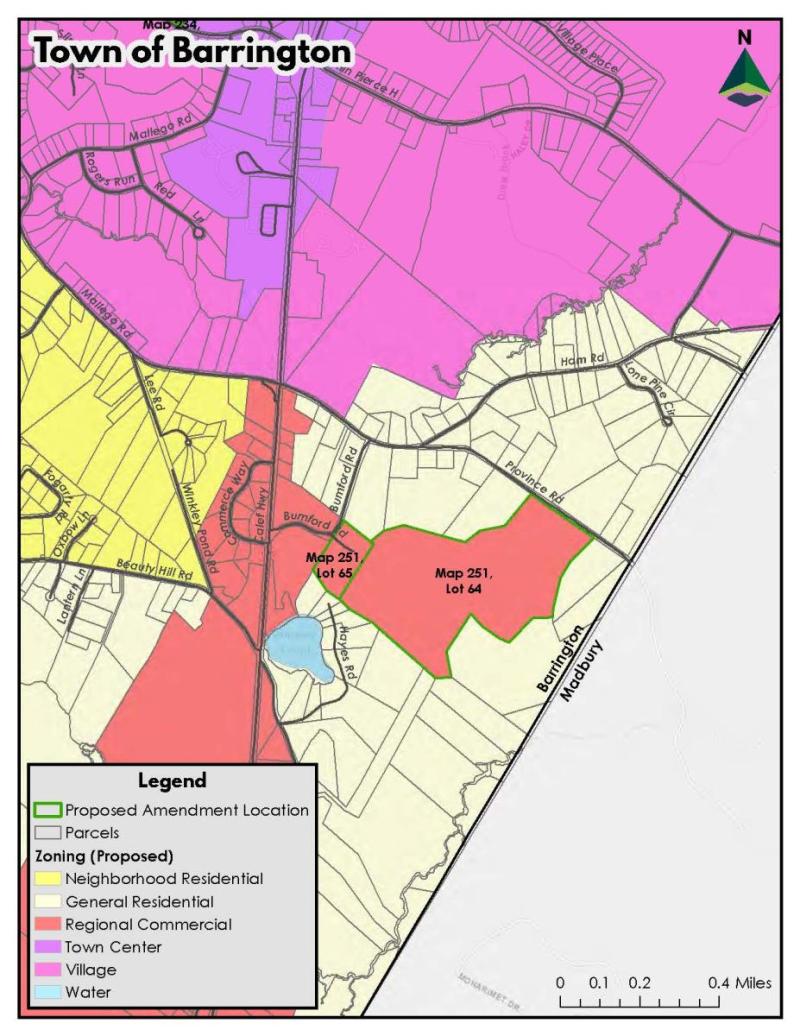

- The first discussed amendment would amend the zoning map by changing Tax Map 251 Lots 64 & 65 from General Residence to Regional Commercial to better reflect the current commercial use of the properties and to increase the opportunities for commercial development on each lot.

Article 3: Zoning

Deliberative Session Video (4 min.)

Zoning Amendments were developed by the Planning Board review their September 20th, October 25th, and November 15th 2022 work sessions for details.

January 3, 2023 Planning Public Hearing Video Recording (1 min.)

- A proposed amendment to section 7.3 would require that a home occupation be conducted entirely within the structure of a single-family dwelling, limit the occupation to 30% or 500 square feet (whichever is less) and to limit the non-resident employees to one. Further, home occupation vs. home business was explained by Mr. Driscoll with the example of a single salon chair vs. multiple, affecting the number of customers and/or employees coming and going.

Article 4: Zoning

Deliberative Session Video (2 min.)

Zoning Amendments were developed by the Planning Board review their September 20th, October 25th, and November 15th 2022 work sessions for details.

January 3, 2023 Planning Public Hearing Video Recording (2 min.)

- Section 7.4 (7) has been proposed to confine home businesses, including storage, to a primary dwelling structure or an outside area which is adequately screened with fencing and/or a vegetative buffer, and to limit the occupation of the business to no more than 2,000 square feet or 10% of the lot, whichever is less.

Article 5: Zoning

Deliberative Session Video (2 min.)

Zoning Amendments were developed by the Planning Board review their September 20th, October 25th, and November 15th 2022 work sessions for details.

January 3, 2023 Planning Public Hearing Video Recording (10 min.)

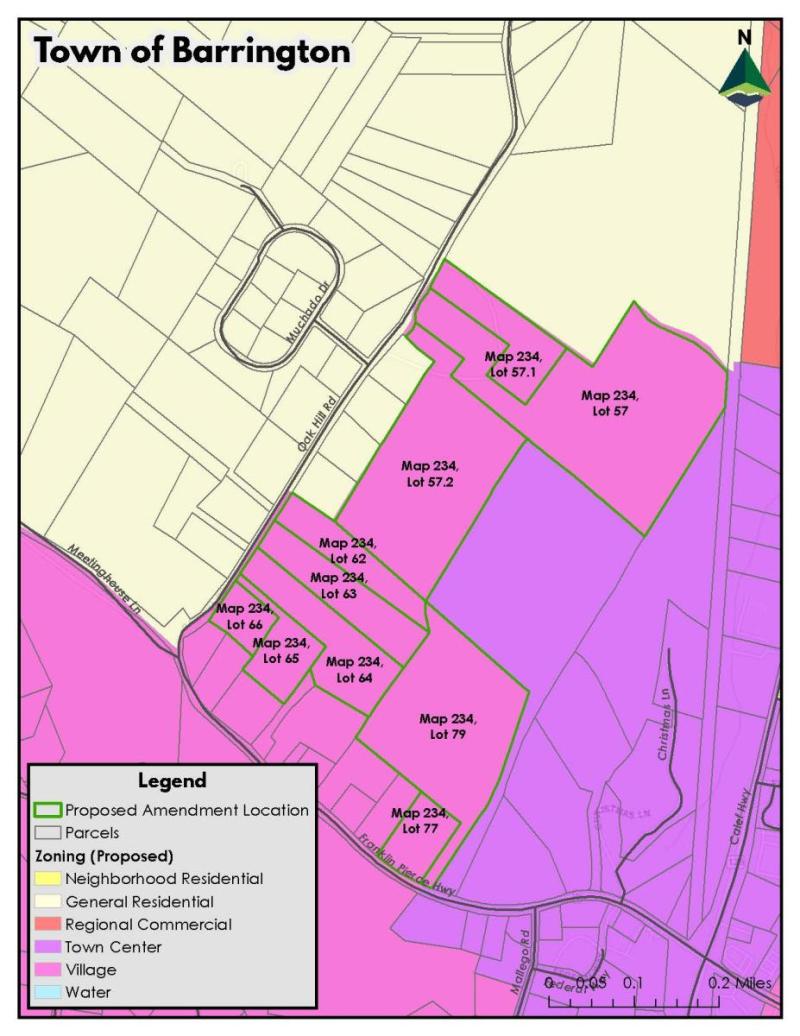

- Brought before voters in 2018 and failing to pass by 114 votes, ten lots on Oak Hill Road and Franklin Pierce Highway are currently zoned as Town Center district; the Planning Board is proposing to re-district the area to the Village District to be more in-line with the surrounding residential neighborhood.

Article 6: Zoning

January 3, 2023 Planning Public Hearing Video Recording (2 min.)

- A change to article 18 would amend “attached building” to be a building having any portion connected by a common roof- (attached to the main structure). This article was proposed by Building Inspector/Code Enforcement Officer John Huckins.

Article 7: Zoning

Deliberative Session Video (1 min.)

Zoning Amendments were developed by the Planning Board review their September 20th, October 25th, and November 15th 2022 work sessions for details.

January 3, 2023 Planning Public Hearing Video Recording (2 min.)

- An amendment to section 20.8.4 regarding temporary signs would allow placement within 60 days of an election (if they otherwise comply with the ordinance) in the General Residential, Neighborhood Residential, Village, Town Center, Highway Commercial Overlay, and Regional Commercial Zoning Districts.

Article 8: Operating Budget

***

The annual operating budget covers all Town departments including Fire/EMS, Police, Highway, Recreation, and the Town Offices. The Select Board and Advisory Budget Committee began review of budget proposals in September of 2022. Throughout the review process, they worked to balance the level of services provided by the Town with inflation and a growing population. The 2023 budget proposal represents an 8% increase and non-property tax revenue represents a 7% increase. At $3, the Town’s property tax rate is 15% of the total tax rate. Inflation made the largest impact on the 2023 budget including vehicle fuel, heating fuel, electricity, paving, salt, staffing, and benefit costs. The entire budget binder and line-item budget is available at www.barrington.nh.gov/2023budget.

Deliberative Session Video (14 min.)

Click Here to visit the comprehensive 2023 Budget webpage which includes the entire contents of the 2023 budget binder used by the Select Board and Advisory Budget Committee.

Click Here for a summary of the budget by department.

Article 9: Town Center Tax Increment Financing District

A TIF District is an instrument to spur economic development in Barrington's Town Center. Barrington has focused much time and energy on the development of a Town Center. This has included the 1988 Adoption of RSA 162-K, 2003 Master Plan Update, 2007 Town Center Plan, 2008 Adoption of the Town Center Zoning District, 2014 Community Profile, 2019 Recreation Needs Assessment and Strategic Plan, updates to the Master Plan, and various changes to the Zoning Ordinance and Zoning Map focused on the Town Center. The vision for this part of Barrington has always included a quaint, safe, walkable Town Center with extensive civic use/open space which support the desire for commercial development. A TIF District invests NEW tax dollars to promote the goals of the District, including civic use public facilities, utilities, and transportation.

At Town Meeting in 1988, Barrington voters adopted the provisions of RSA 162-K which authorizes TIF Districts. This first step of the process laid the foundation to allow the Select Board to propose TIF districts for voter approval. In 2022, the Planning Board and Select Board had numerous conversations around accomplishing the Town's goals for the Town Center. At the center of those conversations was how to pay for investments in the civic use/open space of the Town Center. Both Boards felt that a TIF District was a great way to reinvest the increased tax value in order to promote additional commercial development.

Additional details including the full Development Program and Frequently Asked Questions are available at www.barrington.nh.gov/tif.

Deliberative Session Video (25 min.)

Click Here to visit the comprehensive Town Center Tax Increment Financing District webpage which includes the Development Program and Financing Plan, Frequently Asked Questions, and other details.

Article 10: Bridge and Culvert Capital Reserve

This savings account is primarily used for engineering to make bridge and culvert projects ‘shovel ready’ in order to secure grants for construction. It can also be used for construction if alternative funding sources are not available. Recently the Mallego Road Bridge over the Mallego Brook was replaced with 80% State funding. The Greenhill Road Bridge over the Isinglass River will be replaced in 2023 with 80% State funding. Anticipated upcoming projects in the design phase include the three Young Road causeways along Swains Lake, the culverts at the outfall of Swains Lake Dam, and the Pond Hill Road culverts flowing into Ayers Lake.

Deliberative Session Video (12 min.)

Article 11: Highway Heavy Equipment Capital Reserve

Article 12: Fire Truck Capital Reserve

Contributions and utilization of this capital reserve are guided by a comprehensive equipment replacement schedule which is updated annually: Fire/EMS Truck Replacement Schedule 20220919

This savings account is primarily used for saving for large Fire Department vehicle/apparatus purchases. Recently the Fire Department performed a cab and chassis remount for the Forestry Truck and a similar rebuild for the Tank Truck. Anticipated upcoming replacements include the 2008 F450 Ambulance and Engine 1.

Deliberative Session Video (4 min.)

At their November 28, 2022, the Select Board approved the Fire Department's recommendation to pursue a bid advertisement to refurbish (instead of replace) Engine 1. Initiatives like these help save taxpayer dollars.

Article 13: Fire and Rescue Equipment Capital Reserve

Article 14: Dam Repair/Engineering/Replacement Capital Reserve

Article 15: Police Equipment Capital Reserve

Contributions and utilization of this capital reserve are guided by a comprehensive equipment replacement schedule which is updated annually: Police Equipment Capital Reserve Narrative 20221012

This savings account is primarily used for saving for large and/or infrequent Police equipment purchases. Anticipated upcoming purchases include body cameras, tasers, radars, and communications equipment.

Deliberative Session Video (2 min.)

In 2022, the Police Department secured a $100,000 grant to fund computer upgrades. This grant allowed the department to accelerate the replacement schedule and request less of a contribution in 2023 ($11,000 vs. $90,000 in 2022).

Article 16: Paving and Related Road Work Non-Lapsing Article

***

Article 17: Emergency Communications Upgrades Capital Reserve

Article 18: Transfer Station and Recycling Center Capital Reserve

Article 19: Library and Community Center Capital Reserve

Article 20: Energy Capital Reserve

This savings account is being proposed by the newly created Energy Committee for the purposes of energy efficiency projects and outreach. In 2023, the Energy Committee plans to utilize the funds to perform energy audits at municipal buildings in order to identify opportunities for cost savings.

Deliberative Session Video (18 min.)

At the November 28, 2022 meeting, the Select Board discussed this article and voted to include it on the warrant: Energy Capital Reserve (Video: 5 min.).

Article 21: Library Technology Capital Reserve

This savings account is primarily used for saving for library technology improvements. Anticipated upcoming purchases include IT infrastructure, staff workstations, and customer workstations.

Deliberative Session Video (4 min.)

Article 22: Police Collective Bargaining Agreement

***

The Select Board commissioned a wage study in 2022. The results of the wage study showed that Barrington employees were underpaid compared to the municipal labor market. As a result, the Select Board adopted the recommendations and built the wage increases into the 2023 budget. The Select Board and Police Union agreed to open negotiations a year early in order to incorporate the results of the wage study.

The cost items of the proposed changes include wages, holiday pay, and additional compensation for Field Training Officers. The Select Board approved the tentative agreement at their December 12, 2022 meeting and it was subsequently approved by the Police Union. The full contract, a letter from the Police Union and additional details regarding the negotiation process are available at www.barrington.nh.gov/2022PoliceNegotiations.

Deliberative Session Video (5 min.)

Details of the 2023-2026 Police Union contract and negotiations can be found at: www.barrington.nh.gov/town-administrator/pages/police-union-contract-2023-2026.

Police Union Memo Regarding 2023-2026 Contract Negotiations 20230126

Article 23: Collective Bargaining Agreement Renegotiation and Vote

***

Deliberative Session Video (2 min.)

Article 24: Service-Connected Total Disability Credit

***

In 2019, the Select Board reviewed exemptions and credits available to Barrington residents and identified that Barrington was not offering the maximum credit available to veterans. The Select Board established a plan to incrementally increase the credits to minimize impacts to other taxpayers. In 2019, the Select Board sponsored a warrant article to increase the service-connected total disability credit from $2,000 to $2,550. This article passed at the March 2020 Town Meeting. In 2020, the Select Board sponsored a warrant article to increase the service-connected total disability credit from $2,550 to $3,050. This article passed at the 2021 Town Meeting. In 2021, the Select Board sponsored a warrant article to increase the credit from $3,050 to $3,550. This article passed at the 2022 Town Meeting and is the current value of the credit.

There are currently 43 active service-connected total disability credits in Barrington. The county average credit value is $2,073 and the State average is $1,781. The minimum is $700, and maximum is $4,000.

Deliberative Session Video (2 min.)

Click here to view the full 2022 Exemption and Credit Analysis.

Article 25: All Veterans’ Tax Credit

***

In 2020, the Select Board was presented with a petitioned warrant article to increase the All-Veteran’s Credit from $450 to the new maximum of $750 over three years. The Select Board worked with the petitioner to clean up the warrant article language (which can only change one year at a time). As a result, the Select Board supported an article to increase the All-Veteran’s Credit to $550. This article passed at the 2021 Town Meeting. At Town Meeting in 2022, the Select Board sponsored a successful warrant article to bring the credit to $650. Readoption is also required in 2023 due to statutory changes in the credits.

There are currently 498 active veteran credits in Barrington. The county average is $496, and the State average is $402. The minimum is $50, and the maximum is $750.

Deliberative Session Video (2 min.)

Click here to view the full 2022 Exemption and Credit Analysis.

Article 26: Fiber to the Home Non-Binding Agreement

***

The Barrington Technology Committee has taken a proactive approach to promote bringing fiber internet to the home in Barrington. The committee advertised a Request for Proposals in 2022 and recommended a partnership with Fidium Fiber (Consolidated Communications) to pursue grants and low-interest loans which would help accomplish this goal. Consolidated Communications scored higher in the competitive process due to their current fiber service in Barrington and their capacity for expansion. Multiple providers have fiber services along Routes 125, 9, and 4, but (with one exception) those services do not yet extend to residential areas. A non-binding agreement would allow the Town to collectively advocate and pursue future funding opportunities. Additional details are available at www.barrington.nh.gov/fiber.

Deliberative Session Video (2 min.)

Background and details of the Town's Fiber to the Home initiative can be found at: www.barrington.nh.gov/fiber

At the November 28, 2022 meeting, the Select Board discussed this article and voted to include it on the warrant: Fiber Partnership Warrant Article (Video: 6 min.)

Article 27: Noise Ordinance

***

This article was amended by voters at the February 4, 2023 Town Meeting Deliberative Session. The language above will appear on the ballot on March 28, 2023 (postponed from 3/14). The original language of the summarized warrant article did not include "lawfully discharging firearms (per RSA 159:26)". It is important to note that this exemption was always part of the noise ordinance and is exempted by State law (RSA 159:26).

Barrington voters adopted a noise ordinance in 2001 pursuant to RSA 31:39. It was amended by the Select Board in 2016 and 2017, but those amendments were never adopted by Town Meeting. In 2022, the Select Board, Town Administrator, and Police Chief worked on a proposal to ratify the 2016 and 2017 amendments into an enforceable noise ordinance. Additional details are available at www.barrington.nh.gov/2023noiseupdate.

Deliberative Session Video (32 min.)

Background and details of the proposed 2023 Noise Ordinance Update: www.barrington.nh.gov/town-administrator/pages/2023-noise-ordinance-update

Article 28: By Petition: Code of Ethics

***

This article was amended by voters at the February 4, 2023 Town Meeting Deliberative Session. The language above will appear on the ballot on March 28, 2023 (postponed from 3/14). The originally petitioned language and signature can be found in the document below.

Article 29: By Petition: Duty to Inform

***

This article was amended by voters at the February 4, 2023 Town Meeting Deliberative Session. The language above will appear on the ballot on March 28, 2023 (postponed from 3/14). The originally petitioned language and signature can be found in the document below.

Article 30: By Petition: Court Proceedings Webpage

***

This article was amended by voters at the February 4, 2023 Town Meeting Deliberative Session. The language above will appear on the ballot on March 28, 2023 (postponed from 3/14). The originally petitioned language and signature can be found in the document below.

Article 31: By Petition: Temporary Signs

Deliberative Session Video (17 min.)

This article was amended by voters at the February 4, 2023 Town Meeting Deliberative Session. The language above will appear on the ballot on March 28, 2023 (postponed from 3/14). The originally petitioned language and signature can be found in the document below.

Original Petition and Signatures

Article 32: Other Business

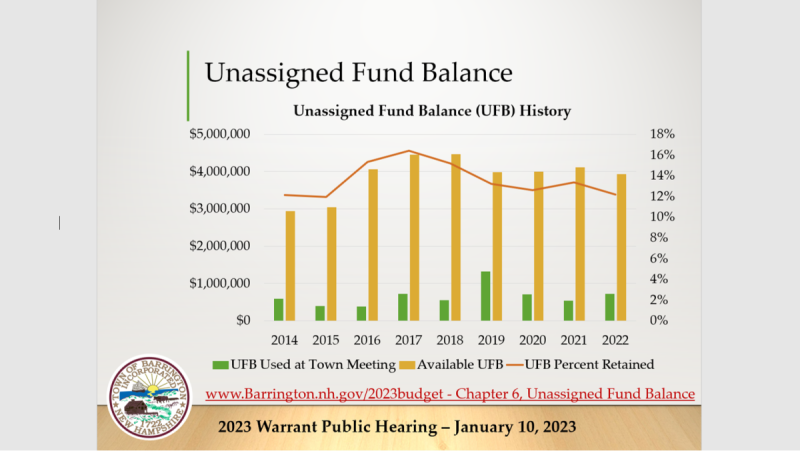

A Note On Unassigned Fund Balance

Unassigned Fund Balance - Budget Binder Section 6

Deliberative Session Video (6 min.)

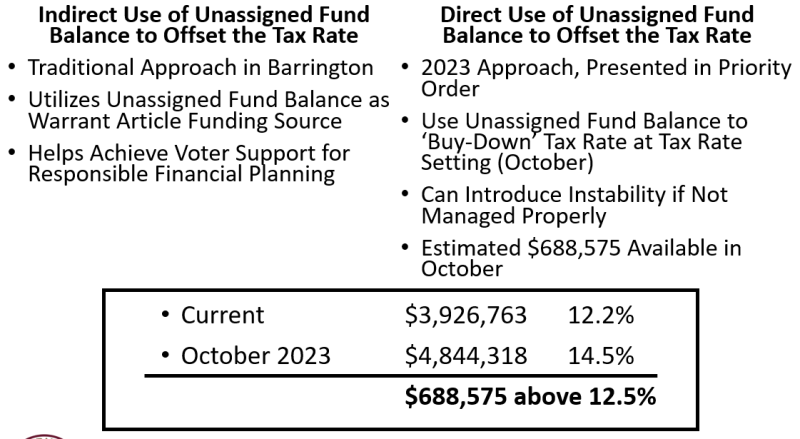

Unassigned fund balance primarily comes from unspent money in the Town’s budget and collecting more revenue than anticipated. The unassigned fund balance is typically used to offset or ‘buy down’ the tax rate either indirectly or directly. It can also be used for emergency appropriations with DRA approval. The estimated balance of in 2023 is 14.5% of the estimated regular general fund operating expenditures. That represents approximately $688,575 above the midpoint (12.5%) of the recommended range.