What does the town do with my property taxes? (11/18/2023)

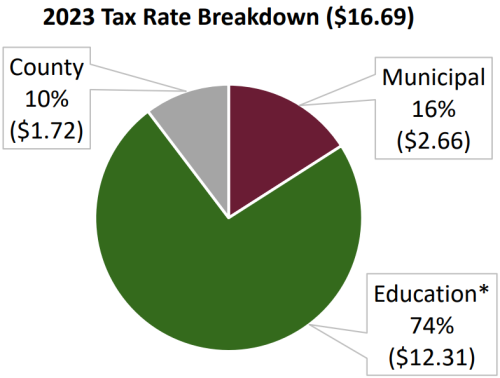

The Town is responsible for collecting all property taxes. The Town sends 84% of the property tax revenue to the school and county. In 2023, the Town will collect $30,700,305 in property taxes.

$22,623,369 (or 74%) will be sent to the school.

$3,177,321 (or 10%) will be sent to the county.

$4,899,615 (or 16%) will be retained to fund municipal services details of the 2023 budget: www.barrington.nh.gov/2023budget. Only 48% of municipal services are funded through property taxes. 27% comes from vehicle registrations, 12% comes from the state (rooms and meals/highway block grant), 7% is fees for services (transfer station, building inspection, etc.), and 6% is miscellaneous. To learn more about the annuals annual non-property tax revenue, check out the revenue chapter of the 2024 budget binder: www.barrington.nh.gov/2024budget#anchor_revenue.