2024 Barrington Town Warrant Information

2024 Town Meeting Voter Guide

2024 TOWN MEETING RESULTS

Sample Town Ballot (pdf)

Sample Zoning Ballot (pdf)

Sample School Ballot (pdf)

Sample Barrington Kids Vote Ballot (pdf)

Executive Summary (tl;dr)

Important Dates

School Warrant Public Hearing: Tuesday, January 2, 2024 at 6:00pm at the Barrington Middle School (51 Haley Drive) (Video Recording)

Zoning Amendments First Public Hearing: Wednesday, January 10, 2024 at 6:30pm at the Town Hall (Video Recording)

Zoning Amendments Second Public Hearing: Thursday, January 25, 2024 at 6:30pm at the Town Hall (Video Recording)

Town Deliberative Session: Saturday, February 3, 2024, beginning at 9am. Barrington Middle School (51 Haley Drive). (Video Recording)

School Deliberative Session: Saturday, February 10, 2024, beginning at 9am. Barrington Middle School (51 Haley Drive). (Video Recording)

Town Meeting (Ballot Session) voting on Tuesday, March 12, 2024 at the Barrington Middle School (51 Haley Drive) from 8:00am to 7:00pm

Table of Contents

Introduction and Warrant Development Process

The annual Town Meeting involves two sessions; the Deliberative Session which was held on Saturday, February 3, 2024, beginning at 9am (Video Recording) and the Voting Session which will be held Tuesday, March 12, 2024 from 8:00am to 7:00pm (both sessions are at the Barrington Middle School).

The 2024 budget and warrant development process started in August. Department Heads start from scratch (zero-based budgeting) and present a proposed budget and warrant article to the Town Administrator. Through meetings and negotiations, the Town Administrator finalized a budget to be presented to the Advisory Budget Committee (ABC) and Select Board. The ABC met more than a dozen times and discussed all proposals with the Town Administrator and Department Heads. The ABC challenged assumptions while reviewing every line-item and funding request. Throughout this process, presentations were made to the Select Board and the public. The budget and warrant articles were finalized after the January 8th public hearing.

Proposed Zoning Amendments were reviewed by the Planning Board starting in October. The group discussed many aspects of the zoning ordinance which needed updates. They considered feedback from residents and applicants while preparing a slate of zoning amendments. The Planning Board held multiple public hearings through late January before finalizing 19 proposed zoning amendments.

This guide/webpage is intended to provide additional details regarding each warrant article. The additional information may include documents or video links. Please use the Table of Contents to navigate directly to the information about a specific warrant article. Please note that the School Warrant/Ballot is created by the School District. We will provide details of the SAU #74 process where available, but we would encourage you to visit www.sau74.org for details.

Questions are encouraged, please send all questions to ask@barrington.nh.gov.

Advertising and Promotion Efforts

We recognize that our residents lead busy lives and it can be challenging to monitor municipal activities all year. The Town takes many proactive steps in support of educating and informing residents about important issues on the local election ballot. The list below includes details of certain advertising and promotional efforts.

- 2024 Bond and Budget Public Hearing Newspaper Advertisement

- The following was published in Foster's Daily Democrat on December 31, 2023

- Legal NoticeTown of Barrington Proposed Bonds and 2024 Budget and Warrant Articles Public HearingPursuant to RSA 33:8-a, I, and RSA 40:13, II-a, the Barrington Select Board will hold a public bond hearing at 6:30pm on Monday, January 8, 2024 at the Town Hall, 4 Signature Drive, Barrington, NH on a proposed $3,319,324 bond for the purchase of 426 Calef Highway (land and buildings) and renovation for the purpose of a new library.Immediately following and also pursuant to RSA 33:8-a, I, and RSA 40:13, II-a, the Barrington Select Board will hold a public bond hearing on a proposed $1,000,000 forgivable loan through the Community Center Investment Program to make improvements, including adding programming space, at 105 Ramsdell Lane, the existing recreation, library, and food pantry facility.Immediately following the public hearing on the bonds, pursuant to RSA 32:5, I and RSA 40:13, II-a (a) the Barrington Select Board will hold a public hearing on the proposed 2024 budget and all other proposed warrant articles. This hearing will also be available for remote participation; details to participate virtually are available at www.barrington.nh.gov. If the hearing on January 8, 2024 is canceled, continued, or additional items need a hearing, there will be a public hearing at 6:30pm on January 16, 2024 at the Town Hall.

- 2024 Local Election Important Dates Banner

- The following banner was installed in the Town Center on 12/27/2023 to inform residents of important local election dates.

- 2024 Voter Guide (PDF)

- The information from this webpage will be printed as an informational Voter Guide to provide residents with important details and background of the warrant articles to be decided on March 12, 2024. The electronic version will be advertised with links and scannable QR codes. Printed copies will be available at Deliberative Session, Town Hall, the Library, the Transfer Station, and at the election on March 12, 2024.

- What's That Warrant Article?

- Every day starting on Wednesday, February 7, 2024 we will feature a warrant article and explanation on our Facebook Page: www.facebook.com/BarringtonNHGov/. The goal is to inform voters and spur discussion of the ballot items voters will decide on March 12, 2024.

-

- Deliberative Session Signs

- On January 24, 2024, placed eight 'Deliberative Session' informational signs around Barrington. The goal is to inform residents of the Town and School Deliberative Sessions.

- VOTE Signs

- On February 14, 2024, we replaced the Deliberative Session signs with VOTE signs at the same eight locations. The goal is to inform residents of the upcoming election.

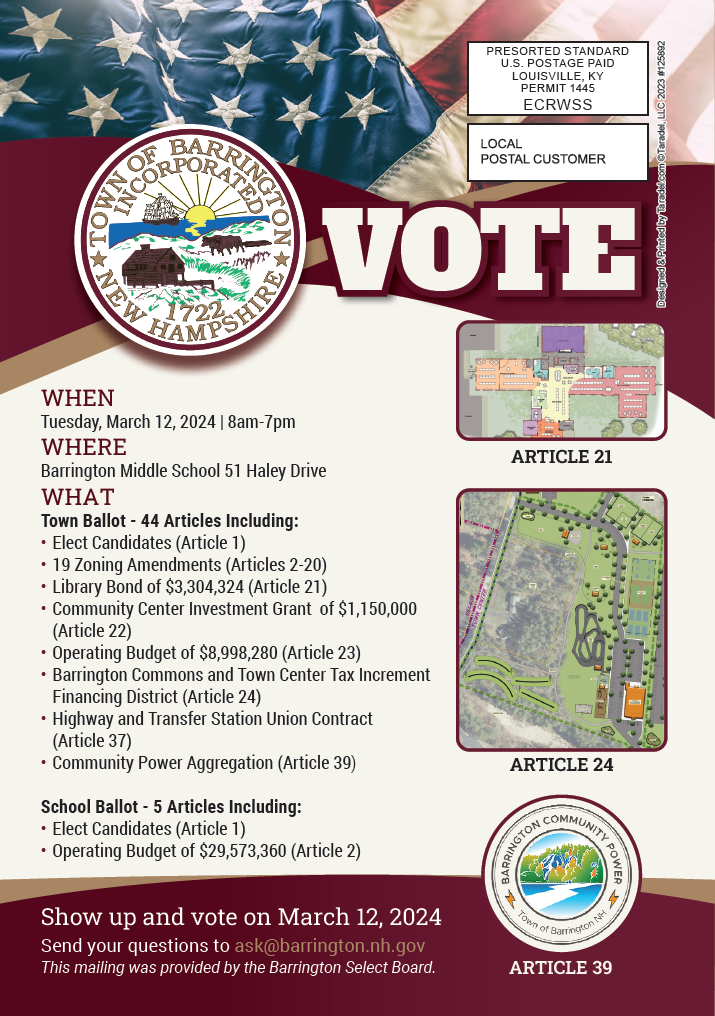

- VOTE Postcard

- On February 27, 2024, a postcard was delivered to all 4,000+ addresses and PO Boxes in Barrington with information about the upcoming vote. The goal is to inform residents of the upcoming election, provide brief details, and information about where to find more information.

- Town Center Property Signs

- On March 5, 2024 signs were installed along the frontage of Map 239, Lot 7 informing the public about Article 24 and where to find more information.

Article 1: Election of Town Officers

***

The filing period for Town Offices was from Wednesday, January 24, 2024 through Friday, February 2, 2024. Click here to view the Town Clerk's filing list.

Details of the 2024 Candidate Forum can be found at www.barrington.nh.gov/2024candidateforum. A recording of the event is available on the Town's YouTube Channel.

Article 2: Zoning - Elderly Assisted Home Care Facilities – Number of Residents

Article 3: Zoning - Senior Housing – Number of Dwelling Units

Article 4: Zoning - Health Care Facilities – Definition

Article 5: Zoning - Self-Storage - One Story

Article 6: Zoning - Nursing/Elderly/Assisted Facilities – Density

Article 7: Zoning - Machine Shop – Definition and Districts

Article 8: Zoning - Truck Terminal – Definition and Conditional Use

Article 9: Zoning - Warehouse – Definition, Conditional Use, and Districts

Article 10: Zoning - Frontage – Consistent Definition

Article 11: Zoning - Defining Various Uses in the Table of Uses

Article 12: Zoning - Restaurant and Outdoor Dining – Definition and Districts

Article 13: Zoning - 200 Sq. Ft. Structures (Sheds) – Definition and Amount Allowed

Article 14: Zoning - Structures – Definition to Include Storage and Generators

Article 15: Zoning - Conservation Subdivision – Yield Requirements

Article 16: Zoning - Signs in the Right of Way

Article 17: Zoning - Minimum Lot Size – Poorly Drained Soils and Contiguous Uplands

Article 18: Zoning - Accessory Building – Definition

Article 19: Zoning - Back Lot Subdivision – Frontage

Article 20: Zoning - Conservation Subdivision – Yield Plan Studies and Use of Commons Space

Article 21: Library Bond

***

Explanation and Additional Details

This building is the former Barrington Family Practice and Walk-In Care facility at 426 Calef Highway (Rte. 125) across from the Barrington Health Center. As a medical facility it was meticulously cared for both inside and outside. The building has been toured by the library trustees, building committee, and both the library’s architect and construction manager with unanimous support for acquiring this property for its potential as a Town library.

Visit the Barrington Library Foundation website for details on this project: https://barringtonlibraryfoundation.org/a-new-barrington-public-library/.

- $3,631,324 - This is the total raise and appropriate number to fund the new library and minor renovations to the existing library space.

- $3,331,324 - This is the budget to purchase and renovate 426 Calef Highway into a library

- $300,000 - This is the additional amount included to make minor renovations to the existing library space at 105 Ramsdell Lane for Recreation and community center purposes

- $327,000 - This is the amount of donated cash on hand from the Barrington Library Foundation to be used to reduce the bond necessary for the proposed library project. This amount may be increased at Deliberative Session on February 3, 2024 to reflect additional donations received by the Barrington Library Foundation through that date.

- $3,304,324 - This is the total proposed bond which reflects the total minus donations. This is the component with a future tax rate impact based on the debt schedule. This number may be reduced at Deliberative Session on February 3, 2024 to reflect additional donations received by the Barrington Library Foundation through that date.

Advisory Budget Committee Recommendation

The Advisory Budget Committee recommends this article by a vote of 4 to 1. The majority feel this is the best proposal to secure a new library for Barrington and to address the space and configuration deficiencies of the existing library at 105 Ramsdell Lane. They feel this approach is more cost effective than new construction and is smaller in square footage than previous proposals. The minority feels that there are more important priorities as part of the Capital Improvements Program which will result in tax increases such as the planned Public Safety Building renovation/addition and infrastructure projects (culverts, roads, and bridges). Financially, residents may need to pick and choose which articles they can support on the 2024 warrant and the operating budget and capital reserve contributions are a higher priority.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that the Library Trustees have listened to voters who defeated new library proposals in 2019 and 2020. They explain that this proposal is smaller and cheaper than any previous proposal.

Frequently Asked Questions

[Return to Table of Contents]

Article 22: Community Center Grant

***

Explanation and Additional Details

Visit the Recreation Department webpage for details of the 2024 Recreation Warrant Articles: www.barrington.nh.gov/2024RecArticles.

Barrington Recreation Department applied for a $1 million CCIP grant opportunity in November 2023. This grant focuses on community centers and bringing residents together. There is a separate library bond warrant article which includes $300,000 to make the existing library space functional. The timing is great to pursue this grant opportunity and address ongoing Recreation needs while lowering the financial impact for residents. This warrant article is contingent on receiving the CCIP grant and we expect to hear about the award sometime in March. The Recreation warrant article is solely for the acceptance of these funds (if awarded), with the required $150,000 match coming from the Recreation Revolving Fund. Below is a breakdown of potential outcomes based on approved funding.

1) Barrington is awarded CCIP grant and library is approved: Available funds would be utilized to retrofit vacated library space and make connection between the two floors. Please see appendix A for floor plan layout.

2) Barrington is awarded the grant, but the library fails: If the library space is not available, we will utilize the available funds to include a small addition off the entrance of Recreation building, and relocate the current offices. The current office space would be transformed into kitchenette to accommodate a variety of multi- generational programming. Please see appendix B for floor plan layout.

3) Grant is not awarded but library passes: We would utilize the $300,000 to maximize impact to upstairs space to ensure the space is as conducive to Barrington residents needs. Renovations would be a simplified version of appendix A to maximize utilization.

- Community Center Investment Program Options and Budget Flowchart with Floorplans

- 105 Ramsdell Lane Energy Audit - September 2023

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that this is in the best interest of the Town since this is a $1 million refundable loan (grant) which is contingent on receiving the award. Additionally, the group appreciates that the Recreation Department is primarily self-funding through user fees and the added space would allow them to provide many additional user-fee-funded programs to the community. They recognize that the 1972 facility requires many improvements both to address the growing population and to address the aging facility. Specifically, the building was built when Barrington had fewer than 2,000 residents and lacks indoor programming space. Additionally a recent energy audit identified many issues which could be addressed with a renovation/addition to the building. This article is a great way to make lasting improvements without a tax burden.

Select Board Recommendation

The Select Board unanimously recommends this article. They have supported and prioritized improvements to the facility at 105 Ramsdell Lane many times in recent years. They appreciate that many of the recent improvements (walls, floors, and bleachers) have happened without an impact to taxpayers (by being funded through the Recreation Revolving Fund) and this article will continue improvements at no taxpayer expense. The grant-funded energy audit is a priority for the Select Board to address and this grant opportunity is a great way to do so.

Frequently Asked Questions

**

Article 23: Operating Budget

***

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that the Town Administrator and Department Heads perform a fiscally sound and thorough budget development process which identifies departmental needs to perform their required level of service. Each budget request is justified by detailed itemization of expenditures and conservative staffing levels to provide those services. Cost of living increases and step increases are the minimal amounts to reward and retain the Town’s dedicated employees. The estimated 2023 unassigned fund balance results from sound management of expenditures with the budget and the fact that State revenues have exceeded expectations and provide the means to fund approximately half of the requested warrant articles presented with this budget.

Previously (under prior Select Boards and Town Administrators) the Advisory Budget Committee (ABC) felt explanations, transparency, and proper controls were lacking. Under new leadership, all of these issues have been addressed and the ABC has great confidence in the process and outcomes. The ABC reviews each Department's budget on a line-by-line basis and provides clarifying questions, challenges, and suggestions in meetings with Department Heads and Town Administrator. Appropriate changes are made to budget which is then presented to the Select Board. Importantly, revenue estimates (local and state) are also critiqued to be as accurate as possible.

Select Board Recommendation

The Select Board unanimously recommends this article. In 2023, the Select Board challenged the Town Administrator and Department Heads to prepare a fiscally conservative budget proposal which maintained Barrington's existing level of service and met the demand for additional services. They feel that the budget, as presented, strikes the perfect balance between cost and level of service. The Select Board is proud of the work staff has done to secure millions of dollars in grants over the past few years (two highlights include over $2 million for the Greenhill Road Bridge and $1.5 million for the Town Hall). In addition to grants, staff have found ways to limit the tax rate impact while also meeting the needs of residents. Specifically, building permit fees were increased (to match the local average) in order to cover the costs of an additional part-time Building Inspector. In addition to raising fees, the Select Board pulled numerous one-time expenditures out of the 2024 operating budget in order to fund them from the Town's remaining balance of ARPA funds (federal stimulus). The Select Board is proud to present a unanimously-supported budget to voters at Town Meeting in 2024.

Frequently Asked Questions

**

Article 24: Barrington Commons and Town Center Tax Increment Financing District

Explanation and Additional Details

This is a plan to preserve Barrington's character consistent with a goal of numerous Master Plans and visioning sessions since 2003. The plan is to buy the 13-acre vacant lot in-between Calef's Country Store, MD Motors (formerly Knight's Garage), and the Elementary School and establish a Barrington Commons park with gathering and recreation features. In addition to the public park benefits, this approach will secure redevelopment and expanded tax base opportunities for abutting properties with frontage/visibility on Routes 125 and 9. Additionally the plan calls for improvements to the Town Center area including school zones, crosswalk(s), and more. To pay for this plan, residents are asked to consider establishing a tax increment financing district which would capture taxes from new development within the district to pay for the plan.

The proposed Barrington Commons and Town Center Tax Increment Financing District is an approximately 484 acre district (~1.5% of Barrington) which captures commercial, public, and recreation property along Routes 9 and 125 in the Barrington Town Center area. This is a plan to preserve Barrington's character and to spur economic development in Barrington's Town Center. Barrington has focused much time and energy on the development of a Town Center. This has included the 2007 Town Center Plan, 2014 Community Profile, 2019 Recreation Needs Assessment and Strategic Plan, updates to the Master Plan, and various changes to the Zoning Ordinance and Zoning Map focused on the Town Center. The vision for this part of Barrington has always included extensive civic use/open space which preserves Barrington's character and supports the desire for commercial development. The footnote of that vision which has regularly been ignored is; how to fund the type of civic use/open space which residents desire. A tax increment financing district would create that funding source by utilizing only the added tax value from within the district.

At Town Meeting in 1988, Barrington voters adopted the provisions of RSA 162-K which authorizes tax increment financing districts. This first step of the process laid the foundation to allow the Select Board to propose tax increment financing districts for voter approval. In 2022, the Planning Board and Select Board started the conversation around accomplishing the Town's goals for the Town Center. At the center of those conversations was how to pay for investments in the civic use/open space of the Town Center. Both Boards felt that a tax increment financing district was a great way to reinvest the increased tax value in order to promote additional commercial development. The Town Administrator held meetings and solicited input from public and private stakeholders alike. This input was incorporated into the Development Program presented to the Select Board.

- Map 239, Lot 7 Purchase and Sale Agreement 20240229

- Barrington Commons and Town Center Tax Increment Financing Public Hearing Presentation

Advisory Budget Committee Recommendation

The Advisory Budget Committee recommends this article by a vote of 4 to 1. The majority feel that this is an excellent opportunity to preserve part of Barrington's rural character and invest in Barrington's future. This warrant article will enable the Town to purchase the last significant parcel of land in the Town Center area that can function as a public gathering place for Barrington residents. In addition, this lot will enable the Town to sell or license well and/or septic capacity to allow additional development and redevelopment of abutting properties, funding future enhancements to support community events. The minority is concerned future development or redevelopment of the adjacent lots is uncertain and may not generate sufficient offsetting revenue. Additionally, they note that a public park would have ongoing operating and maintenance costs, which would become a taxpayer expense once the district expires in eight years.

Select Board Recommendation

The Select Board unanimously recommends this article. It has been a priority for this Select Board to preserve Barrington's character and invest in Barrington's future. Preserving part of Calef's Field and developing places for residents to gather in the Town Center is a large part of the Select Board's vision for this proposal. They saw the 2022 development proposal** for this lot and the marketing materials** currently advertised and both represented extensive high-density residential development including nearly 100 units. They have heard resident concerns about the impacts to Barrington's character, especially as this lot sits atop a high-value aquifer. This plan provides residents a public park (with amenities), school zones, improved hike/bike trails, crosswalks, and other transportation improvements. They feel that using a temporary (eight years) tax increment financing approach is the best way to fund the plan. Tax increment financing takes the new (incremental) taxes generated in the district to directly pay for the proposed improvements. Everyone pays the same in taxes and once the district expires, the Town benefits from expanded tax base.

Frequently Asked Questions

**

Additional details including the full Development Program and Frequently Asked Questions are available at www.barrington.nh.gov/tif.

Click Here to visit the comprehensive Town Center Tax Increment Financing District webpage which includes the Development Program and Financing Plan, Frequently Asked Questions, and other details.

Article 25: Highway Heavy Equipment Capital Reserve

Explanation and Additional Details

- Highway Equipment Replacement Schedule 20230919

- Contributions and utilization of this capital reserve are guided by a comprehensive equipment replacement schedule which is updated annually.

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 26: Fire Truck Capital Reserve

Explanation and Additional Details

- Fire/EMS Truck Replacement Schedule 20230919

Contributions and utilization of this capital reserve are guided by a comprehensive equipment replacement schedule which is updated annually.

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 27: Paving and Related Road Work Non-Lapsing Article

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel these additional funds are essential to continue making progress on the Pavement Management Plan. The $50,000 increase in the operating budget for paving simply funds inflation and does not allow any additional paving. Allowing voters to add $150,000 ensures that we keep up with the Pavement Management Plan.

Select Board Recommendation

The Select Board unanimously recommends this article. Maintaining good roads is of the utmost importance to the Select Board. The Select Board invested in a comprehensive Pavement Management Plan in 2021 and remains committed to implementing the recommendations. The Town will not be able to make progress on the plan in 2024 without the additional non-lapsing funds.

Frequently Asked Questions

Article 28: Dam Repair/Engineering/Replacement Capital Reserve

Explanation and Additional Details

- Dive Inspection Report**

- Letter of Deficiency**

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 29: Old Settler's Road Bridge Project - 20% Grant Match

Explanation and Additional Details

- Powerpoint from Public Information Meeting**

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They recognize the tremendous value of the $880,000 grant for taxpayers. This is the third bridge aid project in Barrington since 2019 (Mallego Road and Greenhill Road). The committee appreciates staff effort in finding additional funding sources for necessary local projects. Funding the local match of $220,000 ensures the project remains on schedule.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that investing in the Town's infrastructure is part of the essential services the Town provides. The project design accommodates the 100-year flood threshold to ensure it can withstand significant weather events. Additionally, the project has a natural bottom and built-in wildlife shelf (at no extra cost) which is better for aquatic and non-aquatic animals alike. They feel this article is very important in order to secure the $880,000 in grant funds.

Frequently Asked Questions

Article 30: Police Equipment Capital Reserve

Explanation and Additional Details

- Police Equipment Capital Reserve Narrative 20230919

- Contributions and utilization of this capital reserve are guided by a comprehensive equipment replacement schedule which is updated annually.

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 31: Fire and Rescue Equipment Capital Reserve

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 32: Emergency Communications Upgrades Capital Reserve

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 33: Public Safety Building Design and Impact Fee Study

Explanation and Additional Details

The 23-year-old Public Safety Building is in need of improvements. A feasibility study was performed in 2022 and it was determined that a renovation/addition of 774 Franklin Pierce Highway was the best option. The police and emergency services propose a future second story addition with a side sally port to ensure the security of any evidence vehicles and provide a secure space for transport. This warrant article would fund the full design of a renovation/addition project which will be presented to voters in 2025. The impact fee study will evaluate if the bond payments for this project can be partially repaid through impact fees assessed on new housing units. An impact fee study is required before the Planning Board can assess impact fees.

- 2022 Feasibility Study**

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel it is important to have this project fully designed before bringing a bond article before voters. The 2022 feasibility study was an important first step and is part of appropriate planning for a multi-million project. They support the consideration for impact fees which assign a cost to the impact new dwelling units have on municipal services.

Select Board Recommendation

The Select Board unanimously recommends this article. They firmly support the proposed $150,000 for design and engineering a plan for the expansion of our current Police and Fire building. They feel that as our Town grows in residents, and households, we need to react to today’s needs and plan for future needs of our municipality. With an impact fee study, we can plan to shift some costs from current residents to future residents and offset taxation for Barringtonites while still providing great public services. Looking to the future and having “shelf ready plans” also allows the Town to react quickly when federal to state grants become available for our Town.

Frequently Asked Questions

Article 34: Bridge and Culvert Capital Reserve

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 35: Transfer Station and Recycling Center Capital Reserve

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 36: Library Technology Capital Reserve

Explanation and Additional Details

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel that saving in capital reserve accounts is the most fiscally responsible way to plan for large future expenditures. The planned purchases from this capital reserve are essential operating costs and should not be deferred. Each year, the Advisory Budget Committee review updated plans for each capital reserve account and challenge Town staff to find cost savings and alternative purchase and replacement options.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that Barrington has a very successful program to save funds in advance of large expenditures. Support from voters is essential because missing an annual contribution to these savings accounts sets the expenditure plan behind. These funds are outside of the operating budget and require Select Board approval for all expenditures which are also monitored by the Trustees of the Trust Funds.

Frequently Asked Questions

Article 37: Highway and Transfer Station Collective Bargaining Agreement

Explanation and Additional Details

During the summer of 2023, the Highway and Transfer employees exercised their right to organize. Negotiations for the first contract were efficient and amicable, taking only three sessions. The Select Board reviewed and approved the terms of the collective bargaining agreement on December 11, 2023. Please find additional details below. The cost items for the Collective Bargaining Agreement will be voted on by residents at the Town Meeting Ballot Session on March 12, 2024.

Details of the 2024-2027 Highway and Transfer Station Union contract and negotiations can be found at: www.barrington.nh.gov/town-administrator/pages/highway-and-transfer-union-contract-2024-2027

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They recognize that the majority of the cost is simply providing the unionized employees with the same wage increases provided to other employees in the operating budget. The other costs are associated with increased services such as having employees on-call during Fridays in the summer. Supporting this article is important for the retention of the valuable employees in the Highway Department and Transfer Station.

Select Board Recommendation

The Select Board unanimously recommends this article. The Select Board remains committed to treating union and non-union employees as equitably as possible. The cost items in this contract provide wage increases for the employees of the bargaining unit in the same manner as other Town employees (step and cost of living). At a time when it is challenging to hire qualified employees to plow our roads, retention of our skilled workers is essential. Approval of the cost items allows the Select Board to implement the collective bargaining agreement which will be in place for three years.

Frequently Asked Questions

Article 38: Collective Bargaining Agreement Renegotiation and Vote

***

Explanation and Additional Details

If voters defeat the cost items of the collective bargaining agreement, the terms will need to be renegotiated and the cost items of the new terms would need to be presented before voters at a special meeting. Passage of this article would allow the Select Board to call a special meeting for that purpose.

Select Board Recommendation

The Select Board unanimously recommends this article. If voters do not approve the cost items of the collective bargaining agreement, it will be important to make adjustments and seek voter support before the following March.

Frequently Asked Questions

Article 39: Community Power Aggregation

***

Explanation and Additional Details

A community power aggregation plan is intended to offer residents the opportunity to benefit from lower electricity rates and greater flexibility in choosing their electricity procurement.

Over 50 other towns and cities in NH have already joined the Community Power Coalition of NH (CPCNH) and have experienced significant savings.

This warrant would only change the default electricity supplier. Eversource will continue to distribute electric power, send bills, and maintain/repair the electrical grid infrastructure. If Barrington votes to enroll in community power all ratepayers retain the right to opt out of enrollment and choose another supplier or stay with Eversource.

Select Board Recommendation

The Select Board unanimously recommends this article. They formed the Energy Committee, in part, to evaluate the new opportunities surrounding community power aggregation. The committee critically reviewed community power and the various options before recommending that the Town move forward with this warrant article. The Select Board recognizes that existing regulations do not adequately incentivize or allow Eversource to secure the most competitive electricity generation pricing. The Select Board supported the Energy Committee's recommendation to join the Community Power Coalition of New Hampshire because, as a non-profit, they have a commitment to serving the interests their members (affordable electricity).

Frequently Asked Questions

Details can be found at: www.barrington.nh.gov/energycommittee

Additional information about CPCNH is available here:

https://www.barrington.nh.gov/energy/communitypower

Article 40: Transfer Station and Recycling Center Revolving Fund

Explanation and Additional Details

This article will allow revenue from the Transfer Station to be used to directly offset expenses. Costs are expected to increase dramatically in 2027 at the expiration of the Waste Management contract (www.barrington.nh.gov/town-administrator/pages/waste-management-contract) and this revolving fund will help to mitigate those cost increases.

The Advisory Budget Committee and Transfer Station and Recycling Center Review Committee unanimously recommended proceeding with this warrant article to establish a Revolving Fund for the Transfer Station which would allow the Town to prepare for a dramatic increase in waste disposal costs at the end of the contract with Waste Management (12/31/2026). The proposal is to retain $225,000 annually as revenue in the general fund to offset taxes (and fund approximately 72% of the Transfer Station). Further, the proposal would target an approximately 20% annual increase in Transfer Station user fees and that additional revenue would be deposited in the revolving fund. A 20% increase in 2024 is expected to generate $45,000 in additional revenue. An additional 20% increase in 2025 would add $100,000 and an additional 20% in 2026 would add $165,000. The result would be approximately $310,000 in time for a new waste disposal contract (where we anticipate a doubling of disposal costs). The group was in favor of this approach which incrementally increased user fees to avoid a doubling of fees in one year. Additionally, the group felt that the balance in the revolving fund could be used to extend the incremental user fee increases and/or pursue other options such as performing transportation using Town equipment/personnel.

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. The Advisory Budget Committee held a joint meeting with the Transfer Station and Recycling Center Review Committee in order to strategize how to manage the expected doubling of fees in 2027 (when the Waste Management contract expires). They acknowledged the value of our current contract, but felt we could not sit on our hands and experience a double of user fees and operating budget expenditures in one year. This revolving fund keeps the general fund revenue constant at $225,000 so it is only additional revenue which is diverted to the revolving fund. Coupled with a gradual increase in user fees over the next few years, the revolving fund will give the Town options in 2027. The Advisory Budget Committee feel this is the most financially sound approach to revenue and expenditures at the Transfer Station and Recycling Center.

Select Board Recommendation

The Select Board unanimously recommends this article. They are proud of the nine-year contract the Town has with Waste Management which has fixed increases for tonnage and hauling. The contract is so good, that in when it expires, the Town will experience a dramatic increase in costs. In 2022, the Select Board tried to negotiate a contract extension, but the terms were not favorable to the Town. Instead of just waiting for cost increases in 2027, the Select Board sought an approach which made more gradual increases to user fees and gave the Town additional options for when the contract expires.

Frequently Asked Questions

Article 41: Fire/Ambulance Revolving Fund - Deposit 100% of Revenue

Explanation and Additional Details

This article allows expenses of the fire and ambulance services to be funded directly through revenue from ambulance fees.

Advisory Budget Committee Recommendation

The Advisory Budget Committee recommends this article 4 to 1. The majority feel that all ambulance revenue should be used for expenses within the Fire and Rescue Department. Along with this article, $55,000 of expenses were able to be moved out of the 2024 operating budget to be funded directly by this revolving fund. This approach simply supports directly using revenue to reduce the property tax burden for fire and ambulance services. The minority feels that utilization of the fire and ambulance revolving fund is not structured enough. Aligning expenditures with revenue is a good idea, but there should be clear expectations of what is funded by the operating budget and what is funded by the revolving fund. Currently, applicable expenses are shared between the two funding sources.

Select Board Recommendation

The Select Board unanimously recommends this article. The unanimous endorsement of this warrant by the Select Board underscores its significance as a proactive and prudent measure to cover the escalating costs associated with emergency services in our community. By supporting this article, we also prioritize the appropriate allocation of funds, keeping ambulance fee revenues within this dedicated fund rather than diverting them to the general fund. This targeted approach enhances accountability and transparency, ensuring that the community’s investment directly benefits our emergency response capabilities. This fund not only ensures our Town’s immediate needs are met, but proactively plans for and avoids potentially higher costs in the future.

Frequently Asked Questions

Article 42: Close Unused Trust Funds and Capital Reserves

***

Explanation and Additional Details

Funds that are created for a specific purpose should be closed once the project/activity/event is completed. Such is the case for the funds to be closed. The Road Reclamation Capital Reserve was established for a project on Hall Road which was completed, the Town Hall has been built, and the Tricentennial celebrations have concluded. This step will keep Barrington's financial accounting clean and current.

Advisory Budget Committee Recommendation

The Advisory Budget Committee unanimously recommends this article. They feel it is important to keep the Town's accounting and records current and closing out unused accounts is a great way to do that.

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that these accounts have been used for their intended purposes and the small balances should be returned to voters as revenue to offset taxes.

Frequently Asked Questions

This action cleans up old and no longer used capital reserve and trust fund accounts.

Article 43: Old Garrison Road Discontinuance

***

Explanation and Additional Details

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that there is no need for the Town to maintain rights across private property. Additionally, they have not found conclusive evidence that the road was ever a Town road. This action will help to clear any confusion by indicating that the Town forfeits any rights it does have.

Article 44: By Petition: Joint Advisory Budget Committee

(BY PETITION)

***

Explanation and Additional Details

Select Board Recommendation

The Select Board unanimously recommends this article. They feel that the joint process could only benefit residents and taxpayers. They appreciate the existing cooperation between the Town and School and recognize that there are areas of joint planning already. The Select Board is optimistic that a joint Advisory Budget Committee could also help find opportunities for operational efficiencies through shared services. Although this article is advisory, if passed, the Select Board intends to honor the proposal and work with the School to convene a joint Advisory Budget Committee.

Frequently Asked Questions

Article 45: Other Business

A Note On Unassigned Fund Balance

Unassigned Fund Balance - Budget Binder Section 6

Unassigned fund balance primarily comes from unspent money in the Town’s budget and collecting more revenue than anticipated. The unassigned fund balance is typically used to offset or ‘buy down’ the tax rate either indirectly or directly. It can also be used for emergency appropriations with DRA approval. The estimated balance in 2024 is 14.6% of the estimated regular general fund operating expenditures. That represents approximately $750,000 above the midpoint (12.5%) of the recommended range.